By Judith Garber and Vikas Saini

We’ve been getting more and more questions about our Fair Share Spending work that assesses whether hospitals are giving back enough in financial assistance and community health investments to justify their generous tax breaks. Two new reports—one from a United States Senate committee and one from the American Hospitals Association—delve into this space and provide very different views. Here’s what you need to know.

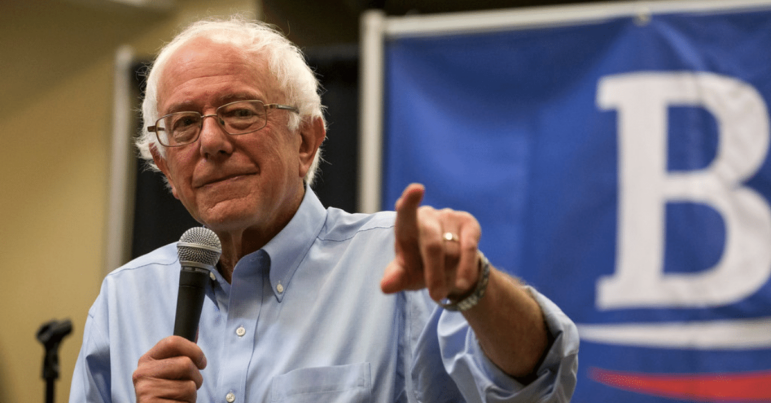

Sanders report calls out hospitals

Nonprofit hospitals receive an estimated $28 billion in total tax breaks each year, but give back far less in meaningful community benefits. A Lown Institute report found that nonprofit hospitals received $14 billion more in tax breaks than they spent on financial assistance and community health programs in 2020, what we call a Fair Share Deficit. About three quarters of hospitals failed to give back to their communities in amounts commensurate with their tax exemption.

In August, four US Senators sent letters to the IRS asking for clarification on how hospitals are complying with the community benefit standard. And this week majority staff of the Senate Health, Education, Labor, and Pensions (HELP) Committee, chaired by Senator Bernie Sanders, released a report showing how some large hospital systems spend little on financial assistance, despite paying their CEOs whopping 8-figure salaries.

The Sanders report highlights examples of nonprofit hospitals engaging in aggressive billing activities such as sending patients’ medical debt to collections and denying care to patients with outstanding medical debt. The report also adds a new analysis of how much the 16 largest nonprofit hospital systems spend on financial assistance (free and discounted care for patients who can’t afford to pay). They find that 12 of these systems spent less than $0.02 for each dollar in revenue on financial assistance, and six gave less than $0.01.

The report also called attention to “massive salaries” for some system CEOs, like Commonspirit which paid their CEO $35 million in 2021. Lown Institute data shows vast inequities at some hospitals, with some CEOs making up to 60 times what other hospital workers make. This underinvestment in financial assistance causes real harm to patients. When hospitals charge patients for care they can’t afford, patients go into debt and often sacrifice basic needs and avoid additional care. An estimated 100 million Americans are in medical debt, and most owe at least some to hospitals. If hospitals paid off their $14 billion fair share deficit, it would be enough to erase the debt of 18 million Americans, which would be a huge step forward for fairness in the country.

AHA provides opposing view

The American Hospitals Association just published their analysis of hospital community benefit spending, finding that hospitals spent $130 billion in 2020, amounting to 15.5% of hospital expenses. That’s far more than other studies estimate.

How can the AHA estimate be so different? The answer depends on what’s being counted as a “community benefit.” When you imagine programs to improve community health, you might think of free immunizations, health fairs and educational classes, food pantries and other nutritional assistance, investments in affordable housing, healthcare for the homeless, etc. However, spending on those types of programs made up only 1.8% of hospital expenses in 2020, according to the AHA’s report.

Financial assistance, free or discounted care for eligible patients, is another important category of community benefit spending. But the AHA report doesn’t break out this amount on its own; instead, they lump it in together with Medicaid shortfall and other unreimbursed costs of government programs.

While it’s important that hospitals care for patients with Medicaid, the “shortfall” they report does not go towards tangible community programs or into the pockets of patients. Instead, this is an accounting item related to the discounted prices in Medicaid. Hospitals offer discounts on care to insurers all the time, but these aren’t considered community benefits–why should Medicaid discounts be any different? Most hospitals already make up this shortfall from public insurers by charging private insurers more than their costs of care. The same goes for Medicare shortfall, which the AHA report also includes in their total, despite this not even being considered a “community benefit” by the IRS.

The AHA report also includes bad debt, which is money the hospital expected to get from patients but never received. The AHA argues this spending is a benefit to the community because many patients who don’t pay would have qualified for financial assistance. However, in the real world, policies on financial assistance vary widely and getting access to it can be easy or hard. If a hospital goes to great lengths to make their financial assistance application simple and accessible, and give more in assistance as a result, that should be rewarded. On the other hand, if hospitals make getting assistance hard and hound low-income patients to pay their bills or send their debt to collection agencies, that hardly seems like a “community benefit.”

What can policymakers do?

The Sanders report adds to existing evidence that nonprofit hospitals could do much more to improve community health and earn their tax-exempt status. How can federal policymakers improve transparency and incentives around the community benefit standard? See some of our key recommendations for Congress on this issue.