5 Things Every Patient Should Know About Hospital Financial Assistance

At the Lown Institute, we spent two years researching the financial assistance policies of over 2,500 hospitals across the United States. We believe that while many hospitals offer financial aid, millions of eligible patients never apply—often because they don’t realize help is available.

To make sure you don’t miss out on potential savings, here are five things every patient should know about hospital financial assistance programs:

#1 – You may qualify for free or discounted care. Really!

Nonprofit hospitals are required to offer financial assistance programs that can reduce or eliminate medical bills for eligible patients. The surprising part? Many people who qualify don’t even realize it.

For a family of three, the typical hospital offers:

- Free care for household incomes up to $53,300

- Discounted care for those earning up to $106,600

Eligibility is usually based on family size and income, so it’s always worth checking—even if you think you might not qualify.

Table 1: Do you qualify for free or discounted care at the typical hospital?

| Household Size | Max Income FREE CARE (200% FPG) | Max Income DISCOUNTED CARE (400% FPG) |

|---|---|---|

| 1 | $31,300 | $62,600 |

| 2 | $42,300 | $84,600 |

| 3 | $53,300 | $106,600 |

| 4 | $64,300 | $128,600 |

| 5 | $75,300 | $150,600 |

#2 – Hospitals must make their policies publicly available

By law, nonprofit hospitals must ensure their financial assistance policies (FAPs) are widely available to the public. This means they should be:

- Posted online (often under “Billing” or “Financial Assistance”)

- Available in print upon request

- Translated into multiple languages if needed

Pro Tip: Hospital websites can be tricky to navigate. To find a financial assistance policy quickly, try Googling: “[Hospital Name] financial assistance policy.” In most cases, it will be the first result!

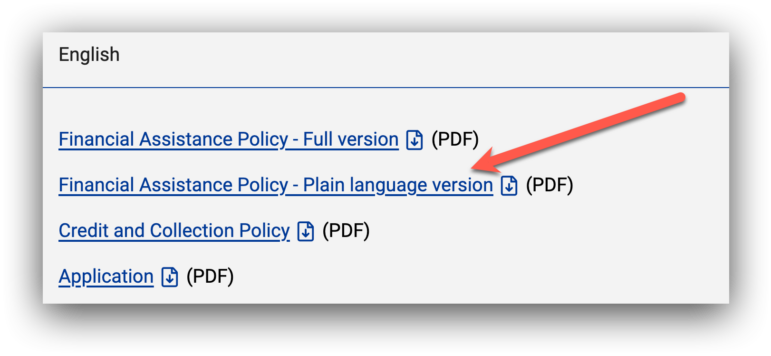

#3 – Look for the “plain language” version

Hospital financial assistance policies can be long and confusing. To make things easier, every nonprofit hospital is required to publish a plain language summary—a simplified version of their policy.

This document should clearly state:

- Who qualifies for assistance

- How to apply

- Income thresholds for free or discounted care

If you’re not sure where to start, look for this summary first. It will help you determine whether you might be eligible before diving into the full policy.

#4 – You may be able to get assistance for large bills…even if you don’t qualify for other help

Think financial aid is only for low-income patients? Think again. Some hospitals offer large bill assistance, even if you don’t qualify for their traditional financial assistance program.

What to look for in a hospital’s policy:

- Phrases like “large bill assistance” or “catastrophic medical expenses”

- A percentage threshold (e.g., many hospitals define a “large bill” as one that exceeds 25% of your annual income)

Don’t be shy about asking about these options. These programs are created for people like you.

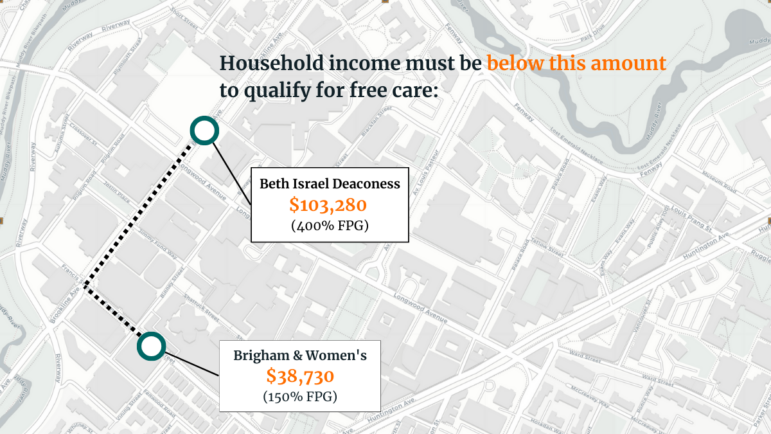

#5 – Check multiple hospitals to find the most generous policy

Not all hospitals offer the same level of assistance. Policies can vary significantly, even within the same city.

For example, in Boston:

- Brigham & Women’s offers free care if a family of three earns less than $38,000.

- At Beth Israel Deaconess, just down the street, that same family could earn up to $103,000 and still qualify.

That’s a huge difference! So take the time to research your options. This variation in policies also applies to large bills.

The bottom line: Don’t assume you’re stuck with the bill

Hospitals aren’t always proactive about offering financial assistance, but that doesn’t mean you can’t take advantage of it. Whether your income qualifies you for free care, discounts, or large bill relief, it’s always worth asking about your options.

If you or someone you know is facing a medical bill they can’t afford, start by:

- Searching for the hospital’s financial assistance policy

- Looking for the plain language summary

- Asking about help for large bills

- Checking multiple hospitals for the best policy

At the Lown Institute, we believe hospitals should do more to ensure patients receive the care they need—without the burden of medical debt. Stay informed, know your rights, and don’t be afraid to advocate for yourself!

Learn more about Lown’s research into hospital financial assistance policies.

Disclaimer: The standards for eligibility discussed in this article are provided as general examples and do not guarantee qualification for any specific hospital’s financial assistance program. Consult individual hospital’s policies and the relevant regulatory guidelines to determine actual eligibility and benefit levels.