Tackling medical debt in America: Insights from experts and advocates

On May 15th in Washington, DC, the Lown Institute brought together advocates, researchers, and hospital leadership to discuss one of the most pressing issues facing the American healthcare system: Medical debt.

As Lown president Dr. Vikas Saini said, medical debt is not just a financial burden, but a symptom of a broader crisis in healthcare affordability. This crisis is driven by a range of factors like market consolidation, administrative waste, an aging and ailing population from chronic disease, and a culture that prioritizes profit over care.

“We’re all here because this issue is a moral stain on the fabric of the country… We’re also here because if we want to fix this, we can.”

– Dr. Vikas Saini, Lown Institute

Through a series of panel discussions, over 80 attendees explored the research behind medical debt, how some hospitals are taking the lead in protecting patients, and which state and federal policies will impact this issue going forward.

See some of our key takeaways and video recordings from the panels below!

Setting the stage

To kick off the event, Fred Cerise (Parkland Health & ABIM Foundation), Patricia Kelmar (U.S. PIRG), David Shuster (Horizon Goodwill Industries), and Dr. Vikas Saini (Lown Institute) shared stories about how medical debt impacted people they work with and work for, and how their organizations have taken big steps toward solving the problem.

For example, Patricia Kelmar shared the story of one patient who received an estimate of $600 for the cost of an imaging test they needed for their job, but later were billed $8,000. With the help of advocates they were able to contest the new bill, but the story shows how opaque and confusing healthcare billing has become. In another case described by Fred Cerise, a patient attempted to operate on themselves rather than go to the hospital and potentially incur more debt. Once the patient found out that they could qualify for free care, it changed their perspective on their life and health.

“You can’t be disruptive without hitting speed bumps.”

– david shuster, Horizon Goodwill Industries

David Shuster explained how his organization decided to go outside of the mainstream insurance-based system and contract directly with primary care doctors. Enrollment in this innovative coverage option was limited until he brought physicians and employees together during open enrollment to explain how it works and begin the relationship building process.

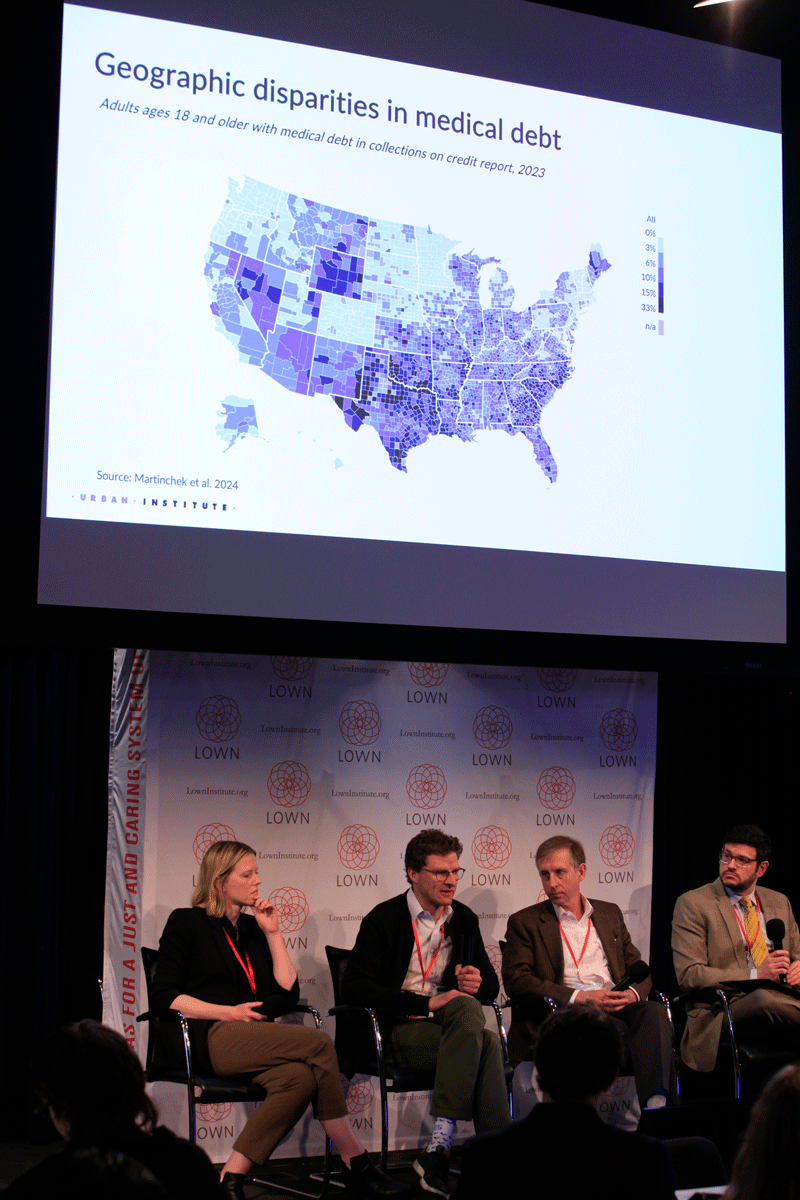

What we know about medical debt (and what’s missing)

In a session on medical debt research, Fred Blavin (Urban Institute), Kelsey Chalmers (Lown Institute), Noam Levey (KFF Health News), Matthew Rae (KFF), and Chris Goodman (University of South Carolina) painted a picture of the scope and drivers of medical debt. Experts presented data showing medical debt has declined in collections—but that doesn’t mean the problem is solved. In fact, many debts are still hidden in credit card balances, loans from family, or informal payment plans offered by hospitals.

Part of the problem is that many medical debt estimates fail to capture the scope of the problem. Researchers at KFF are tackling this issue by taking a more holistic approach, looking beyond credit data to include people who are paying off debt over time, put medical bills on a credit card, or borrowed from family and friends. “The [KFF] survey is designed to get at real lived experiences of people out there,” said Noam Levey.

Kelsey Chalmers also shared new data from the Lown Institute on variation in hospital financial assistance policies. In some cases, hospitals very close to each other have very different policies around eligibility for free or discounted care.

However, there’s still important research to be done. A few research topics that panelists cited on their wish lists were linking specific medical services to debt through claims data, and understanding how people outside of the U.S. experience medical debt.

How hospitals can prevent medical debt

In a hospital-focused session, panelists Fred Cerise (Parkland Health & ABIM Foundation), Connor Coursey (Small Business Majority), Dr. Deepak Manmohan Goyal (Monument Health), Eli Rushbanks (Dollar For), and Eva Stahl (Undue Medical Debt), and Noam Levey (KFF Health News) discussed how hospitals are addressing medical debt and where we could push further.

“They’re looking at all of this from a thousand-foot, disconnected view from the actual patient.”

– eli rushbanks, dollar for

Deepak Goyal and Fred Cerise shared changes they made at their hospitals, such as using presumptive eligibility to remove patient debt from collections that should go to charity care, and stopping the reporting of debt to credit agencies. They cited system fragmentation, lack of awareness, and fear of legal repercussions as common barriers to change for hospital financial assistance policies and practices. “There are so many siloed off-sections within these organizations,” said Eli Rushbanks. “They’re looking at all of this from such a thousand-foot, disconnected view from the actual patient.”

Strategies like being able to more easily verify patient income for financial assistance eligibility – potentially through government-led data sharing – could go a long way.

State Solutions – Progress from the Ground Up

Speakers Elisabeth Benjamin (Community Service Society of New York), Nicole Dozier (North Carolina Justice Center), Maanasa Kona (Georgetown University, Center on Health Insurance Reforms), Luvia Quiñones (Illinois Coalition for Immigrant and Refugee Rights), and Anthony Wright (Families USA) shifted the conversation to the states, unpacking recent progress in New York, North Carolina, and Illinois.

These legislative wins, according to our panelists, were grounded in having airtight data from court records, using this data to put pressure on hospitals, and building coalitions with other advocacy groups and policymakers.

“We had many stories lined up from across the state so they wouldn’t think that it was only a Chicago issue.”

– luvia quiñones, illinois coalition for immigrant and refugee rights

Other advocates pointed to storytelling and focused messaging as important catalysts for change. “We had, I don’t know how many stories lined up, from across the state so they [policymakers] wouldn’t think that it was only a Chicago issue, because that’s usually what we’re told – that it’s a “city issue,’” said Luvia Quiñones.

Federal Solutions – A Murky Path Forward

While threats of Medicaid cuts and other coverage rollbacks loom large in the federal political landscape, panelists Blair Elliot (Third Way), Michelle Sternthal (Community Catalyst), and Dr. Vikas Saini (Lown Institute) pointed to the progress made under the previous administration as a roadmap for what’s possible, such as the CFPB’s final rule banning credit reporting of medical debt.

However, the panelists did not sugarcoat the current situation. Speaking to Medicaid cuts being proposed in the reconciliation process, Michelle Sternthal said, “Let’s be very clear: That [proposal] will explode medical debt and people are going to die.”

The panelists urged attendees to get creative in thinking about the policy levers best positioned to address medical debt in the here and now. Disrupting trends contributing to medical debt like market consolidation and taking a closer look at tax policies and nonprofit hospital compliance with provisions of the ACA are just a few places to start.

Systemic Solutions – Addressing the Root Causes

The conference concluded with a conversation on system reforms that could truly change the landscape of medical debt. Speakers Ge Bai (Johns Hopkins University), Sara Collins (Commonwealth Fund), Ed Weisbart (Physicians for a National Health Program), Wes Yin (University of California, Los Angeles), and Berneta Haynes (National Consumer Law Center) emphasized that we operate within a highly inefficient and expensive healthcare system that is resistant to large-scale change. Issues like the fragmentation of the healthcare system, inadequate health benefits, and systemic commodification of care have perpetuated the medical debt crisis we find ourselves in today.

Sara Collins pointed out that other countries perform much better on healthcare affordability than the U.S. High-performing countries like the Netherlands, U.K., and Germany are in part so successful because they restrict out-of-pocket healthcare expenses – a major source of medical debt in the U.S. In 2023, more than 40% of Americans reported spending more than $1,000 on out-of-pocket medical costs.

“Racism really is at the heart of why we have these problems, particularly anti-Blackness.”

– BERNETA HAYNES, NATIONAL CONSUMER LAW CENTER

Panelists also discussed the pros and cons of a national health plan, public option, pricing transparency and regulatory reform, and rate-setting models. Despite the array of health policy options that lay at our feet, we must consider reforms beyond those strictly to our health system. Berneta Haynes reminded attendees that our history of slavery and segregation played a large role in preventing the implementation of universal healthcare, and that racism remains a barrier today. “It [racism] really is at the heart of why we have these problems, particularly anti-Blackness,” she said.

A Call to Action

Medical debt is more than just a line item on a credit report. It’s a barrier to care, a source of health disparities, and a drag on the economy. But through data, storytelling, and coalition-led reforms, we can move toward a system where care doesn’t come with a crushing bill.

“At the end of the day, it’s not about mourning. As the saying goes, ‘Don’t mourn, organize.'”

– Dr. Vikas Saini, Lown Institute