Healthcare corporations spent trillions of dollars on payouts to shareholders, study finds.

By Vikas Saini and Brenna Miller

It’s well known that America spends more and gets less for its health care dollar than peer countries, and has for a while. Where does all the money go? A recent research letter in JAMA Internal Medicine shows how much of healthcare industry profits are directed to corporate shareholders.

Healthcare companies gave trillions to shareholders

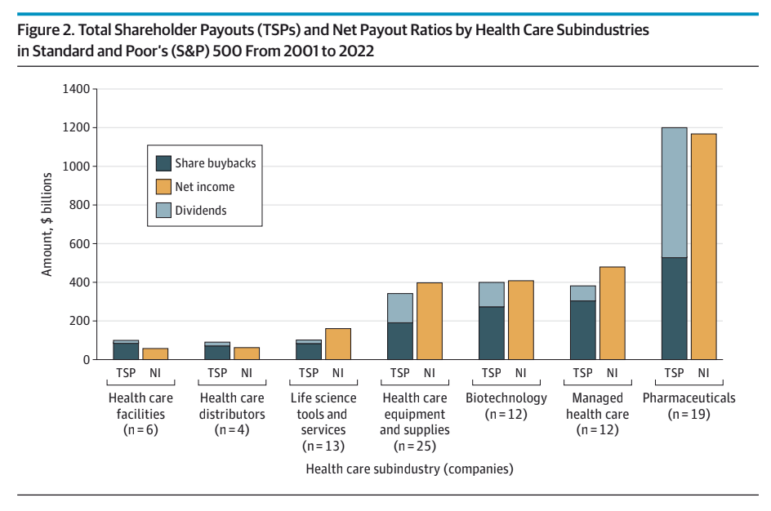

Researchers looked at all health care companies listed on the S&P 500 health care index from 2001 to 2022 and found that they spent $2.6 trillion on dividends and share buybacks, amounting to 95% of all profits made in the sector. During the same time period, the number of healthcare companies on the index almost doubled and total shareholder payouts tripled from $54 billion to $170.2 billion. Share buybacks (when companies buy their own shares to increase the value of remaining stock) particularly benefit high-up executives who are compensated largely through stock options.

The pharmaceutical industry accounted for the largest aggregate payouts by far, collectively returning $1.2 trillion to shareholders, followed by managed health care, biotechnology, and health care equipment and supplies. This is in line with previous research showing that many large pharmaceutical companies spend more on buybacks and dividends than they do on research and development.

“The functioning market is a fantasy”

Some may see shareholder payouts as well-deserved, or at worst, “business as usual.” After all, the theory of capitalism is that private companies rightfully reward shareholders with dividends when the company has entered a market with a needed product and has enhanced efficiency to achieve its financial success. But this viewpoint assumes that the healthcare system operates like other markets, when in fact its market failures are well documented, from abuse of the patent system to massive consolidation to a lack of downward pressure on prices.

As we told USA Today, “The whole idea that there’s a functioning market is a fantasy. Given that fact, the way money flows is not at all rational, and that’s why we get what we get in terms of the prices of everything.” In fact, there are persuasive arguments that health care inherently cannot function like a normal market.

What do Americans get for these payouts?

This study shows an important consequence of our profit-based healthcare system: prioritization of shareholders over patients. While the medical-industrial complex gives back billions to shareholders each year, 25% of Americans struggle to afford their prescription drugs and 100 million Americans have encountered some form of medical debt, which remains a leading cause of bankruptcy in the country.

As we told USA Today, “It’s a value question for the society. Is there a point where it’s perfectly reasonable or is there a point where it’s totally obscene? Clearly, for shareholders, it’s not obscene. They love it.” But for most Americans, including many, if not most, Trump voters, it is obscene.

The authors of the study concluded that “increasing capital distributions to shareholders of publicly traded companies may be associated with higher prices and may not be reinvested in improving access, delivery, or research and development.”

Ultimately, the trillions of dollars funneled into shareholder pockets over the past two decades shows the result of a profit-driven healthcare system run amok. While investors reaped the benefits, millions of Americans struggled with the financial burden of getting care. The data in this paper shows that to make all Americans healthy at a price we can afford we need to put limits on the market’s incessant drive to siphon off profits to shareholders at the expense of patients.