Medicare drug price negotiations: The first drug list is here!

Last year, Democrats achieved a policy goal that experts have been recommending for years to reduce drug costs–allowing Medicare to negotiate down the price of certain drugs. As part of the Inflation Reduction Act passed last year, Medicare will be able to negotiate pricing for ten high-cost drugs that have been on the market for more than seven years and do not have a generic version.

For these drugs, Medicare will set a “maximum fair price” based on several factors, including manufacturer costs of research, development, and distribution; comparative drug effectiveness and therapeutic alternatives; and how much the government supported research and development related to the drug.

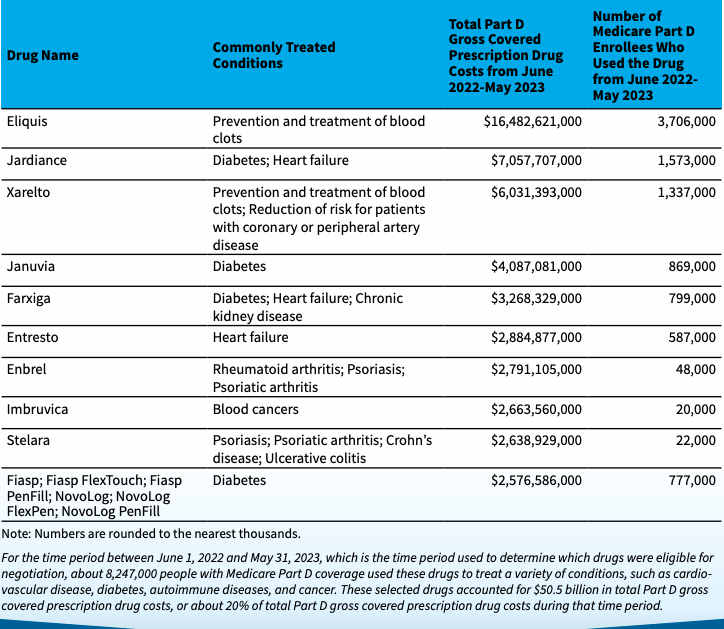

The first ten drugs for potential negotiation were selected last month (see below). In total, these drugs cost Medicare about $50 billion last year, and accounted for $3.4 billion in out of pocket costs for Medicare recipients.

Medicare Drug Price Negotiation Program: Selected Drugs for Initial Price Applicability Year 2026

If some of these names look familiar, it’s because these brand name drugs have been in the news over the past few years. Here’s a rundown of our previous blogs related to these drugs…

Blood thinner boondoggle

Eliquis and Xarelto are blood thinners that cost Medicare a combined $22.5 billion last year, according to CMS. This high cost to Medicare may be related to the companies’ pricing strategy. The Lown Institute gave the manufacturers of these drugs a “dishonorable mention” in the 2022 Shkreli Awards for allegedly raising their prices in concert. From the blog:

Anticoagulant drugs Eliquis and Xarelto were revolutionary when they hit the market in 2011 because they were safer than the previous standard of care. But as their popularity has grown over the past decade, so has their price, reported advocacy group Patients for Affordable Drugs. PAD’s 2022 report alleges that drug companies Pfizer and Johnson & Johnson have increased the prices of their drugs in lockstep, a practice known as “shadow pricing.” The prices for both of these drugs have more than doubled since 2011, and Eliquis and Xarelto are now the #1 and #3 most costly Medicare drugs, respectively.

25x price increases

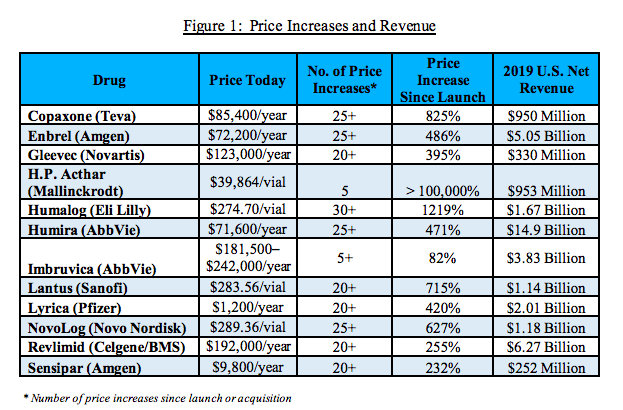

A 2021 report from the Congressional Committee on Oversight and Reform called out Enbrel (a drug for rheumatoid arthritis) for increasing their price more than 25 times since its initial market launch.

The report, which utilized 1.5 million pages of internal documents and took three years to compile, found that pharma companies target the US for price increases because Medicare can’t negotiate, even as they keep prices flat or lowering them in the rest of the world. The report examined 12 drug prices and found that ten had increased in price 20 times of more since they came to market. Amgen in particular increased the price of Enbrel more than 25 times, for a total price increase of 486% since market launch. Amgen made more than $5 billion in revenue from this drug in 2019.

Another drug on the Medicare price negotiation list was also investigated in the congressional report. Imbruvica, a drug for blood cancers, was one of the few drugs that didn’t have 20 or more price increases– but they did increase the price more than five times for an 82% overall price increase. The drug made AbbVie $3.83 billion in revenue in 2019.

Drug ads that scare

Here’s a throwback from the Lown Institute blog archives. We included Entresto, a heart failure drug, and Eliquis in our Halloween series on scary pharma advertisements. Here’s an excerpt from our 2017 blog about the ominous “Keep it Pumping” ad campaign from Entresto manufacturer Novartis:

Novartis’ 2016 ad campaign called “Keep it Pumping” featured a TV advertisement warning that “with heart failure, danger is always on the rise.” As a man ignores the water rising around him, a voice-over says, “About 50% of people die within five years of being diagnosed [with heart failure].” Although the Novartis drug Entresto wasn’t explicitly mentioned, viewers were told to “talk to their doctor about heart failure treatment options.” Many doctors and researchers, including the head researcher on an Entresto study, criticized the ad for fear-mongering.

How are stakeholders responding?

Several pharmaceutical manufacturers, including Merck, J&J, and AstraZeneca have filed lawsuits to try and block the price negotiation (Astellas recently dropped their suit). Trade groups like the pharmaceutical lobbying group PhRMA and the National Infusion Center Association are also suing.

Given that pharma companies stand to lose billions each year from price reductions to their blockbuster drugs, it’s not surprising that they’re pushing back. What’s more interesting is the lack of response from hospitals on the negotiations. Large hospital and medical organizations like the American Hospitals Association have not publicly commented, noted Bob Herman in Stat News. Why not? One would think that hospitals would want lower drugs prices, but hospitals can make a hefty profit by passing along drug price markups to insurers (particularly if they are getting a discount on the drugs). Herman also points out that hospitals might not want to endorse price negotiations for drugs if they could later be subject to price negotiations on reimbursements for medical services.

The fact that Medicare may be negotiating drug prices soon is a historic win for patients. A successful first round of negotiations could put America closer to where other countries stand on drug price affordability, so we’ll be following this issue as we get closer to implementation.