How one Medicare Advantage insurer made billions from overdiagnosis

UnitedHealth Group, the nation’s largest healthcare company, is under fire for allegedly encouraging clinicians to overdiagnose peripheral artery disease in their Medicare Advantage patients to inflate profits.

A recent STAT News investigation—including an analysis of Medicare claims data from the Lown Institute—found that the health care company pressured their 90,000 affiliated physicians to use a medical device to screen patients for peripheral artery disease, despite the device’s questionable accuracy. Positive findings resulted in higher patient risk scores, increasing UnitedHealth’s Medicare reimbursements by about $3,600 per patient.

What is peripheral artery disease?

Peripheral artery disease (PAD) results from the buildup of plaque in arteries, which reduces blood flow and, in extreme cases, can lead to amputation or life-threatening complications. Approximately 8 to 12 million patients in the U.S. have PAD, and it’s frequently underdiagnosed in low-income communities and among Black Americans.

However, the value of mass screening for PAD is unclear. Right now, the U.S. Preventive Task Force does not recommend screening patients without symptoms. Despite the lack of evidence to support widespread screening, UnitedHealth was allegedly encouraging systematic screening of everyone using a medical device called QuantaFlo.

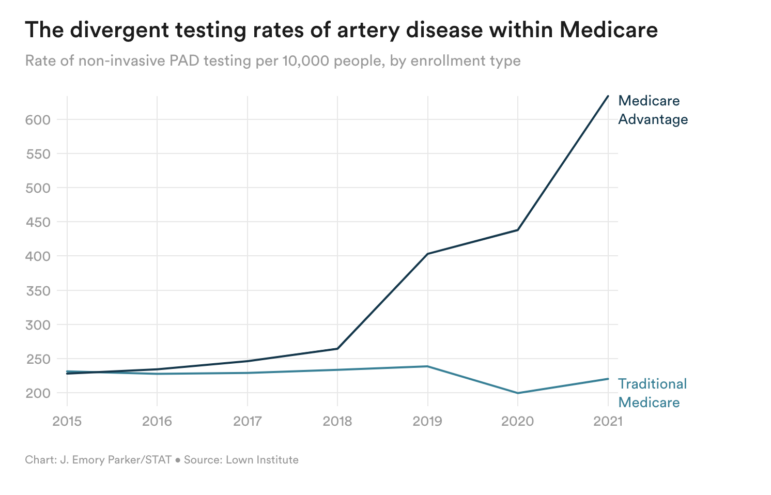

A Lown Institute analysis of Medicare claims conducted for STAT News showed that the rate of non-invasive PAD screening using QuantaFlo and other products increased greatly between 2018 and 2021 among Medicare Advantage patients, while the rate of diagnoses actually decreased among traditional Medicare patients. UnitedHealth alone had more than 1.3 million unspecified artery disease diagnoses from 2018-2021, resulting in an estimated $4 billion in government reimbursements.

“Generally insurers want to reduce overdiagnosis and overtreatment in order to save their own money, but in this instance, that’s not the case,” said Vikas Saini, MD, president of the Lown Institute, reacting to the STAT News article. “Here UnitedHealth is making a bet that they can increase the diagnosis to boost their payments from the government without incurring associated treatment costs. And it’s a good bet since the earlier you screen for chronic conditions the more likely you are to find low risk versions of the disease.”

The risk of false positives

Many of these PAD diagnoses for Medicare Advantage patients are likely false positives. QuantaFlo was marketed as being comparable to the ankle brachial index, the current medical standard for diagnosing PAD. However, the limited data supporting its use is based on studies sponsored by the device manufacturer and have very small sample sizes. One study, for example, showed that about 1 in 10 people will receive a false positive; that conclusion was drawn from evaluating the device in just 15 patients.

“Usually a high rate of false positives in a test is a wasteful downside, but here it’s a feature and not a bug,” said Dr. Saini. “UnitedHealth gets to label lots of people as higher risk and harvest the dollars even when those people do not have the disease.”

These false positives are not without consequences. Patients can be scared by new, unfamiliar diagnoses. They may also be subjected to treatments they don’t need, which come with their own risks. And of course, all of this overtesting, overtreating, and upcoding leads to unnecessary spending at the expense of taxpayers.

Medicare Advantage should be able to avoid overuse by paying insurers for keeping patients healthy, rather than for patient volume. But because plans are run by private companies who are generally trying to maximize profits, there are numerous ways to game the system. We need much more oversight of Medicare Advantage insurers, both because its better for our pockets and better for the patients.